Introduction: ESG Has Entered the Core of Brand Strategy

The global activewear industry is undergoing a structural shift. Environmental responsibility, labor transparency, and governance credibility once considered supplementary have become central determinants of brand competitiveness.

Consumer behavior, regulatory enforcement, capital markets, and international trade policies are converging around a single reality: brands without credible ESG foundations will increasingly lose market access, consumer trust, and investor confidence.

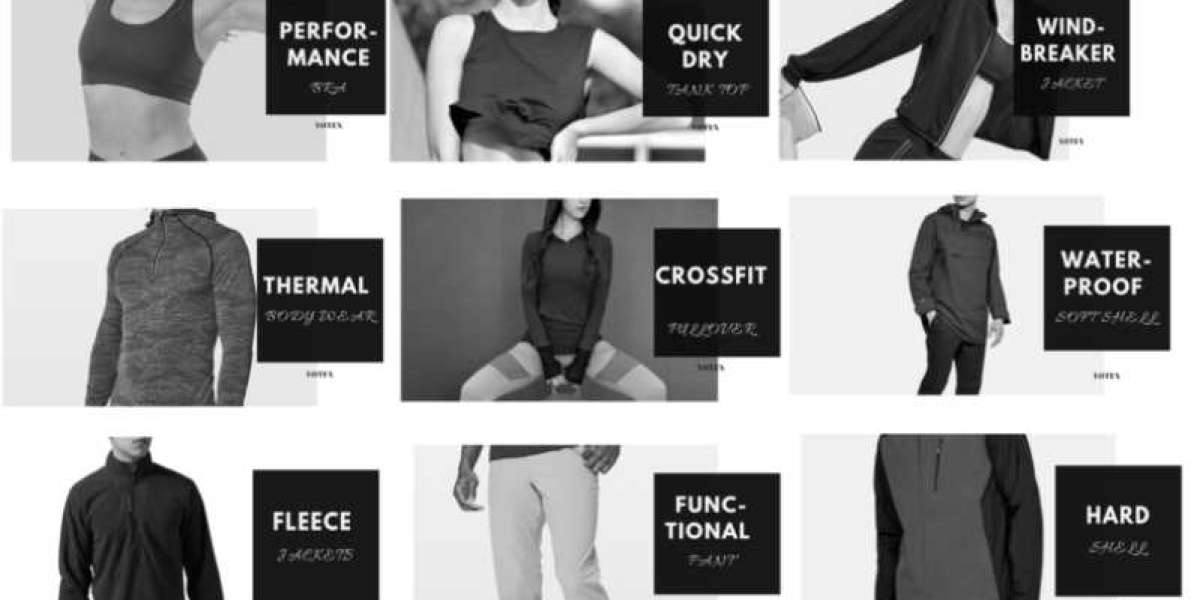

For activewear brands operating in performance-driven categories, this shift presents a dual challenge. Sustainability expectations are rising, yet performance, cost control, and speed-to-market remain non-negotiable. The result is a growing reliance on manufacturing partners that can deliver verified ESG compliance without compromising technical capability.

YOTEX Apparel represents a new generation of performance-focused manufacturers embedding ESG not as marketing language, but as operational infrastructure. This article examines why ESG has become a competitive necessity in activewear manufacturing—and how credible OEM partners are redefining the industry standard.

ESG as a Competitive Filter in the Global Activewear Market

Consumer Demand Has Become Structural, Not Ideological

Multiple global studies now confirm that sustainability considerations are no longer fringe preferences. According to research cited by Harvard Business School, over 70% of global consumers factor environmental and social responsibility into purchase decisions. Among Gen Z and Millennials—the core growth demographic for activewear—that figure exceeds 85%.

More importantly, sustainable purchasing behavior correlates strongly with:

- Higher repeat purchase rates

- Increased brand loyalty

- Willingness to pay 10–25% price premiums for verified ethical products

In activewear specifically, sustainability sensitivity is amplified. Athletes and fitness consumers typically demonstrate higher awareness of environmental impact, material performance, and brand ethics—making ESG a purchase qualifier, not a differentiator.

Regulation Is Forcing ESG Accountability Upstream

Sustainability is no longer self-regulated. Governments are now mandating supply-chain-level accountability:

- EU Corporate Sustainability Reporting Directive (CSRD) requires brands to disclose environmental and social impacts across manufacturing partners.

- U.S. Uyghur Forced Labor Prevention Act (UFLPA) enforces strict import bans without documented labor compliance.

- California Transparency in Supply Chains Act mandates public disclosure of labor risk mitigation measures.

These regulations fundamentally shift responsibility to manufacturers. Brands can no longer outsource ESG risk—they must prove it, factory by factory.

Capital Markets Now Price ESG Risk

Institutional investors increasingly treat ESG performance as a proxy for operational risk. Brands with weak ESG controls face:

- Higher cost of capital

- Reduced access to institutional funding

- Increased scrutiny during MA or IPO processes

Conversely, brands with transparent, certified supply chains benefit from improved valuation multiples and financing conditions. In this environment, manufacturing partners have become strategic ESG assets, not interchangeable vendors.

The Manufacturing Reality: Why ESG Starts at the Factory

Environmental Impact of Apparel Production

The apparel industry remains one of the world’s largest industrial polluters:

- ~9 trillion liters of water consumed annually

- Over 92 million tons of textile waste generated each year

- Synthetic fiber production contributing heavily to carbon emissions and microplastic pollution

Without structural changes at the manufacturing level—materials, energy systems, water treatment—brand-level sustainability claims lack credibility.

Labor Risk Is a Business Risk

Labor practices are no longer viewed solely through ethical lenses. Poor labor standards expose brands to:

- Import seizures

- Legal penalties

- Reputational crises amplified by social media and NGOs

Manufacturers must therefore demonstrate verifiable labor compliance, not self-declared standards.

YOTEX’s ESG Framework: From Compliance to Infrastructure

Environmental Stewardship Embedded in Production

YOTEX has implemented sustainability at the process level, not as post-production mitigation.

Key initiatives include:

- Extensive use of recycled polyester, reducing carbon footprint by ~30% versus virgin fibers

- Integration of organic cotton, bio-based polymers, and plant-derived fibers

- Closed-loop water systems reducing water consumption by over 40%

- OEKO-TEX certified dyeing and chemical management

- Energy optimization programs delivering 40%+ energy efficiency gains

- Roadmap toward carbon-neutral manufacturing by 2030

These initiatives reflect long-term capital investment rather than symbolic ESG positioning.

Labor Standards with Third-Party Verification

YOTEX’s labor compliance is externally audited and certified:

- BSCI Certification – comprehensive labor rights and workplace standards

- WRAP Certification – apparel-specific ethical production compliance

- Alignment with ILO conventions on wages, working hours, safety, and freedom of association

Beyond compliance, YOTEX invests (Email: info@yotex-apparel.com) in worker training, education support, and healthcare programs—recognizing workforce stability as a productivity driver.

Supply Chain Transparency and Traceability

YOTEX operates full traceability systems covering:

- Material sourcing

- Factory-level production data

- Certification documentation

- Audit records and corrective action logs

This enables brand partners to support ESG claims with evidence—meeting regulatory, investor, and consumer scrutiny simultaneously.

Why ESG-Capable Manufacturers Create Brand Advantage

Risk Reduction

Working with a certified, transparent manufacturer significantly reduces regulatory, legal, and reputational exposure—particularly as ESG enforcement tightens globally.

Premium Positioning

Verified sustainability enables brands to justify premium pricing and build long-term loyalty, especially among younger consumers.

Capital Growth Enablement

Brands with ESG-aligned supply chains are better positioned for venture funding, institutional investment, and global expansion.

Defensible Differentiation

Unlike price or trend-based differentiation, ESG credibility compounds over time and is difficult to replicate quickly.

Looking Forward: ESG as a Permanent Industry Filter

Sustainability requirements will continue to intensify:

- Mandatory disclosure will expand globally

- Carbon accounting will become standard

- Microplastic and chemical regulations will tighten

In this environment, manufacturing partners define brand viability.

Conclusion

ESG is no longer a branding exercise—it is operational infrastructure. Activewear brands that fail to embed sustainability at the manufacturing level will face rising costs, shrinking markets, and credibility erosion.

YOTEX Apparel demonstrates how performance manufacturing and ESG rigor can coexist. Through certified labor standards, clean production systems, transparent supply chains, and long-term environmental investment, YOTEX enables brands to compete responsibly in a rapidly evolving global market.

The next generation of successful activewear brands will not ask whether ESG matters—but whether their supply chain can withstand scrutiny.