When Rajesh launched his manufacturing unit in Pune last year, he anticipated a smooth start. What he didn't expect was a three-month delay in his GST registration that would nearly drain his working capital and force him to turn away major clients. His story isn't unique; thousands of Indian businesses face similar challenges when New GST registration gets delayed.

Understanding how registration delays affect your cash flow isn't just about accounting; it's about survival in today's competitive market. Let's explore the real-world impact of these delays and, more importantly, what you can do about them.

Why GST Registration Delays Happen

Before we examine the cash flow impact, it's essential to understand why these delays occur in the first place. In my experience working with over 200 businesses through the registration process, several patterns emerge consistently.

Documentation issues top the list. The GST portal requires specific documents in prescribed formats, and even minor discrepancies—a signature mismatch, unclear photographs of business premises, or outdated address proof—trigger rejections. Each rejection-resubmission cycle adds 7-15 days to your timeline.

Technical glitches on the GST portal, particularly during month-end periods, can halt applications mid-process. While the government has improved infrastructure significantly since 2017, server issues and system maintenance windows still cause unexpected delays.

Verification delays at the jurisdictional level vary dramatically by location. Metropolitan areas with dedicated GST officers often process applications within 3-7 days, while applications in tier-2 and tier-3 cities can languish for weeks awaiting physical verification.

Incomplete or incorrect applications account for nearly 40% of delays. Many businesses rush through the application process without understanding requirements, leading to queries from GST officers that extend timelines considerably.

The Direct Cash Flow Consequences

The impact of registration delays on cash flow manifests in several concrete ways that affect your daily operations and long-term financial health.

Lost Revenue Opportunities

Without a valid GSTIN, you cannot issue GST-compliant invoices. This seemingly simple fact has profound implications. Many established businesses and government entities refuse to work with unregistered vendors, regardless of how competitive your pricing or superior your product quality.

Consider the B2B sector, where compliance is non-negotiable. A software development startup in Bangalore lost contracts worth ₹15 lakhs during a two-month registration delay because their corporate clients required GST invoices for their input tax credit claims. These weren't delayed contracts—they were permanently lost to competitors who could provide proper documentation.

E-commerce sellers face even harsher realities. Platforms like Amazon and Flipkart mandate GST registration before you can list products. Every day of delay represents not just lost sales but also lost momentum in building customer reviews and seller ratings that determine long-term success.

Input Tax Credit Blockage

Here's where delays create a genuine cash trap. You're purchasing raw materials, paying rent, buying equipment—all with GST embedded in these costs. However, without registration, you cannot claim input tax credit on these purchases.

Let's work through a real example. A textile trader in Surat purchases inventory worth ₹10 lakhs monthly. With 12% GST, that's ₹1.2 lakhs in tax paid every month. Over a three-month registration delay, ₹3.6 lakhs of working capital gets locked up—money that could have been recovered through ITC if registration had been timely.

The situation worsens because you cannot retroactively claim ITC for the period before registration in many cases. Some businesses discover they've permanently lost the right to claim thousands of rupees in legitimate tax credits simply because registration was delayed.

Working Capital Pressure

Cash flow isn't just about revenue—it's about timing. When registration delays occur, businesses face a dangerous squeeze from multiple directions simultaneously.

You're still paying suppliers (with embedded GST you can't recover), meeting payroll, covering rent, and managing operational expenses. However, without the ability to issue proper invoices, client payments often get delayed or reduced. Many businesses report that clients use the lack of GST registration as leverage to negotiate extended payment terms or even price reductions.

This creates a classic working capital crisis. Your cash outflows remain constant or increase, while inflows diminish. I've seen businesses resort to expensive short-term loans at 18-24% annual interest just to bridge this gap, adding another layer of financial stress that continues long after registration is finally approved.

Inventory Management Challenges

Manufacturing and trading businesses face unique inventory-related cash flow problems during registration delays. You need to maintain stock to fulfill orders once registration comes through, but you're essentially pre-paying GST on this inventory without any immediate offset mechanism.

A pharmaceutical distributor in Hyderabad shared that during their registration delay, they had to maintain ₹25 lakhs worth of inventory to serve existing customers on credit terms. The GST component alone was ₹3 lakhs—money locked in stock they couldn't legally sell with compliant invoices.

Some businesses make the costly mistake of halting operations entirely until registration completes, which creates different but equally severe cash flow problems as fixed costs continue while revenue stops completely.

Hidden Costs That Compound the Problem

Beyond direct cash flow impacts, registration delays trigger several hidden costs that many business owners overlook when calculating the true damage.

Opportunity costs represent real economic losses. The market doesn't wait for your paperwork. Competitors gain market share, seasonal demand windows close, and strategic partnerships form without you. A fashion retailer missing the festive season due to registration delays doesn't just lose three months of sales—they lose the entire year's primary revenue opportunity.

Compliance penalties can accumulate if you continue operations without registration when you should be registered. Late registration fees under Section 47 of the CGST Act can reach ₹10,000, and interest on delayed tax payments at 18% per annum adds up quickly on any tax liability that existed during the unregistered period.

Relationship damage with suppliers and customers carries long-term financial implications. Suppliers may tighten credit terms or demand cash in advance once they perceive registration issues as a sign of business instability. Customers who switch to competitors during your delay may never return, representing permanent revenue loss that extends far beyond the registration period.

Sector-Specific Impacts

Different business sectors experience registration delays differently, with unique cash flow challenges that require tailored responses.

Service providers—consultants, agencies, freelancers—often face lower absolute costs but higher percentage impacts. A digital marketing agency with low physical inventory but high-value contracts can see 80-90% revenue disruption during delays, as virtually all potential clients require GST invoices.

Manufacturers deal with complex supply chains where registration delays create cascading problems. Without registration, some manufacturers cannot even receive essential raw materials from GST-compliant suppliers who are reluctant to sell to unregistered entities and lose their own ITC claims.

Traders and distributors in the middle of supply chains experience the most severe cash crunches. They face pressure from both suppliers demanding payment and customers delaying payments due to invoice issues, creating an impossible financial squeeze.

Startups and new businesses often have minimal cash reserves, making even short delays potentially fatal. Unlike established businesses that can weather temporary disruptions, startups may burn through their entire seed capital waiting for registration approval.

Strategies to Minimize Cash Flow Impact

While some delays are unavoidable, proactive strategies can significantly reduce their cash flow impact on your business.

Front-load the registration process as early as possible. Don't wait until you need the GSTIN to start the application. Begin the process during your business planning phase, ideally 60-90 days before you plan to commence operations. This buffer absorbs most unexpected delays without affecting revenue generation.

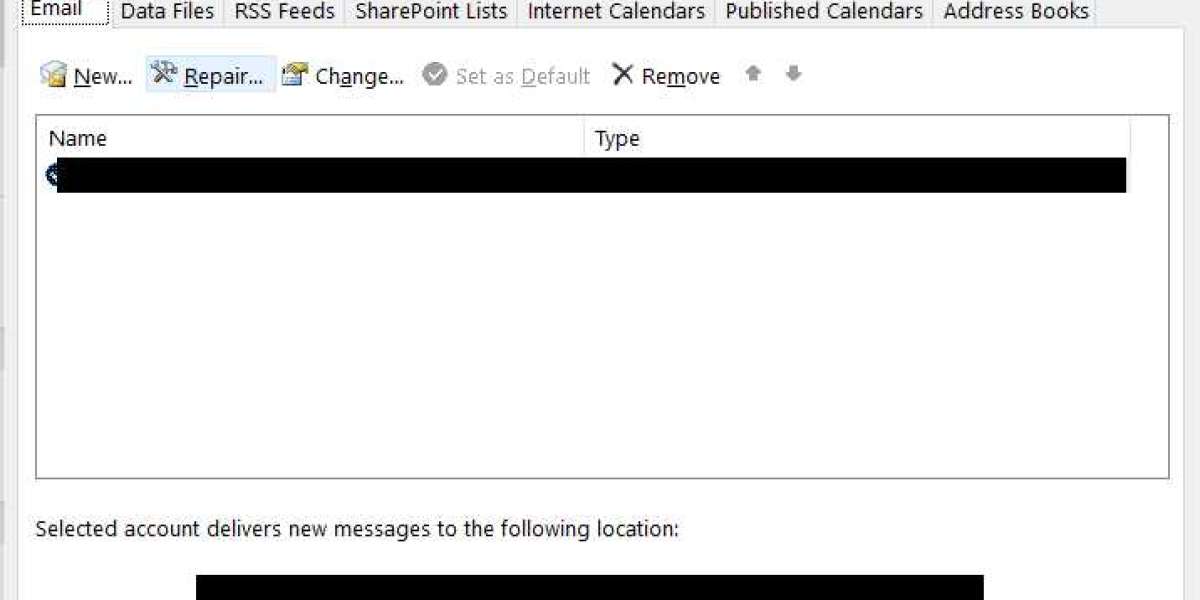

Ensure application accuracy by working with experienced GST practitioners who understand your state's specific requirements. The ₹5,000-10,000 spent on professional help typically prevents delays that cost ten times that amount in lost cash flow. Have all GST Registration documents reviewed by someone who has successfully processed similar applications recently.

Maintain meticulous documentation of all purchases during the pre-registration period. Even if you cannot claim immediate ITC, proper documentation sometimes allows for credit claims once registration is approved, depending on specific circumstances and timelines. Consult with your tax advisor about your eligibility.

Communicate proactively with customers and suppliers about your registration status. Transparency builds trust. Some clients may agree to work with you on alternative terms during the delay, perhaps through cash transactions or deferred formal contracting, rather than simply moving to competitors.

Build cash reserves specifically for the registration period. If possible, maintain 3-6 months of operating expenses in reserve when starting a business, explicitly accounting for potential GST registration delays in your financial planning.

Track your application obsessively. Check the GST portal daily, respond immediately to any queries or requests for clarification, and don't hesitate to visit your jurisdictional GST office in person if the online status seems stuck. Physical follow-up often accelerates applications that have stalled in the digital queue.

What to Do If You're Already Delayed

If you're currently experiencing a registration delay, immediate action can still limit the cash flow damage.

Escalate through proper channels. The GST portal has a grievance redressal mechanism. State GST helplines can provide status updates and sometimes expedite genuine cases. Document all communication for accountability.

Consider temporary alternatives within legal boundaries. Some businesses arrange partnerships or temporary arrangements with already-registered entities to facilitate critical transactions, though such arrangements require careful legal structuring to ensure compliance.

Renegotiate terms with existing commitments. Banks may offer short-term overdrafts or increased credit limits if you demonstrate that registration is pending. Suppliers might extend payment terms if they understand the situation is temporary and you have a history of reliability.

Focus on cash-positive activities that don't require GST registration. Some business activities, particularly in the service sector or B2C segments with customers who don't need GST invoices, can generate cash flow even during registration delays.

The Path Forward

GST registration delays are frustrating and financially damaging, but they're a solvable problem with the right approach. The businesses that navigate these delays most successfully are those that anticipate them, plan for them, and respond proactively when they occur.

Remember that registration, once obtained, is permanent. The cash flow pressures you face during delays are temporary challenges, not permanent obstacles. With proper planning, professional guidance, and persistent follow-up, you can minimize the impact and emerge with your business fundamentals intact.

The most important lesson from businesses that have weathered registration delays successfully is this: start early, document thoroughly, follow up relentlessly, and maintain cash reserves. Your future self will thank you for the preparation, and your cash flow will reflect the wisdom of proactive planning over reactive scrambling.

If you're currently facing a GST registration delay, take action today. Review your application status, ensure all documentation is correct, follow up with your jurisdictional officer, and implement cash flow preservation strategies immediately. Every day of delay costs money, but every day of proactive management reduces that cost significantly.